Things You Need To Know About Unfunded Liabilities

Oct 12, 2022 By Susan Kelly

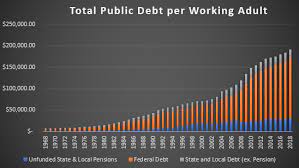

Unfunded liabilities are debt commitments for which insufficient money is put aside to cover the full amount of the obligation. In general, when people talk about "liabilities," they are referring to the obligations or pension plans held by the United States government and the effect such plans have on savings and investment securities. Unfunded obligations may have a materially detrimental effect on the economic well-being of a country or organization as a whole.

A debt with no assets to support it either now or in the future is referred to as an unfunded obligation. The entity responsible for the debt does not have the cash necessary to pay it. For illustration's sake, a corporation may have a pension plan that provides for the payment of $35,000 to each employee once they reach retirement age. Suppose the firm has had financial difficulties and has not been contributing to its pension fund. In that case, it will not have the funds necessary to fulfill the anticipated commitments for the retiring workers shortly.

How Unfunded Liabilities Work

Debt may be used to support activities for a company or a government, and arrangements can be made to repay the debt at some point in the future. Their debts may never be paid off. In corporate finance, this is not always an unethical activity; it only depends on how the company is structured and how it manages its assets. An unfunded liability is a debt owed to a fund intended to make payments to individuals or organizations. This debt indicates insufficient money available to meet the financial responsibilities associated with the debt. These funds might be financed by tax collections or by investing the money in mutual funds, stocks, or bonds to increase the balance to the point where the obligations are sufficiently met. This could be done to meet the expectation that these funds would be funded.

A company may need to use earnings, borrow money, or free up cash to keep a fund afloat in this circumstance. The firm may need to reduce its workforce to maintain its profitability. This would result in a lower overall balance for the pension fund since there would be fewer workers who are eligible to make contributions. The consequence might have a domino or snowball impact. The choices available are to carry out more downsizing, limit payments, do away with the fund entirely, file for bankruptcy, or discontinue operations altogether.

Types of Unfunded Liabilities

Unfunded liabilities may be anything an organization owes but does not have the cash to meet the necessary payments. This might include tax obligations, pension obligations, or any other obligation. A pension fund is the most typical example of this sort.

Pension Funds

Pension plans often require active participants to contribute to the fund while still actively employed. They have worked for many years and will be rewarded with a pension once they reach retirement age. The management of the fund may choose to invest the money in the fund and put the money that is made back into the fund to maintain the fund.

Additionally, the number of people who have already retired significantly influences the financing of pensions. The firm may need to reduce its workforce to maintain its profitability. The number of retirees anticipated to receive payments may exceed the number of contributors. For instance, if more and more members of the baby boomer generation continue to enter retirement, a proportionally smaller number of employees may be paid to pension funds.

Governmental

The Social Security Trust Fund is an example of a government responsibility that does not have sufficient funds to cover it. When Franklin D. Roosevelt established the Social Security Administration (SSA) in 1935, there were already more than sufficient payees to sustain the number of persons receiving payments from the SSA (retirees).

What It Means for Investors

The government, taxpayers, companies, lenders, and investors are all considered stakeholders of unfunded liabilities. For instance, since taxpayers provide the income that is used to pay the salaries and benefits of government workers, they are the ones who experience the impacts of the unfunded obligations associated with pensions. Because of the growing amount of unfunded obligations, more payments are required. This implies that more available money is allocated to pensions rather than being used for other resources and services. There is a possibility of decreased returns for corporations supported by shareholders as the firms try to feed their money.

Susan Kelly Sep 29, 2022

What Is The Best Time To Go Shopping?

Triston Martin Nov 15, 2022

All About Wealth Tax

Susan Kelly Jan 12, 2023

Which Student Loan Rate Is Best For You

Susan Kelly Jan 02, 2023

A Complete Guide to the FHA Refinance Loan Options

Susan Kelly Sep 05, 2022

Affect of Climate Change On Companies

Triston Martin Dec 05, 2022