5 Cs of Credit

Aug 07, 2022 By Triston Martin

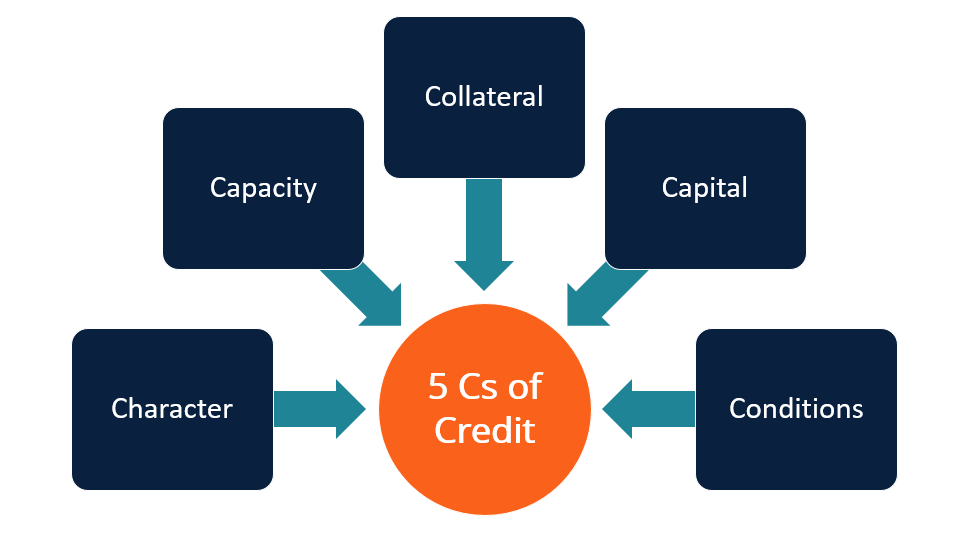

The algorithm takes into account five aspects of the borrower and the terms of the loan to make an educated guess as to the likelihood of the borrower defaulting on the loan and, as a result, the likelihood of the lender incurring a financial loss. Character, capacity, capital, collateral, and conditions make up what is known as the "5 Cs" of credit.

Acquiring Knowledge of the 5 Cs of Credit

The approach to appraising a borrower known as the "five Cs of credit" takes into account both qualitative and quantitative indicators of creditworthiness. The lending institution may review the credit reports, credit scores, income records, and other papers about the borrower's financial status. In addition to this, they look at information about the loan itself.

The evaluation of a borrower's creditworthiness is conducted in a manner that is unique to each lender; nonetheless, the usage of the "5 Cs"—character, capacity, capital, collateral, and conditions—is typical of credit applications submitted by individuals as well as by businesses.

1. Character

Even though it is named character, the first C relates more precisely to credit history. Credit history is the reputation or track record of a borrower when it comes to repaying loans. These details will be included in the borrower's credit reports. The three major credit bureaus—Experian, TransUnion, and Equifax—are responsible for compiling credit reports, which include specific information about an applicant's borrowing history, such as the total amount of money they have borrowed in the past and whether or not they have paid back loans on time.

Lenders use the information included in these reports to assist them in assessing the borrower's credit risk. A credit score is a tool that lenders use to get a rapid overview of a consumer's creditworthiness before looking at their credit reports. For example, FICO analyses the information on a consumer's credit report to construct a credit score.

2. Capacity

The capacity of the borrower to repay a loan is determined by analyzing the borrower's debt-to-income (DTI) ratio and contrasting the borrower's income against their reoccurring financial obligations. To get a borrower's debt-to-income ratio, lenders sum up all of the borrower's monthly loan payments and then divide that number by the borrower's gross monthly income. If an applicant has a lower DTI, there is a greater possibility that they will be approved for a new loan.

Before granting an applicant's request for fresh financing, most lenders require that the applicant's DTI be at or below 35 percent. Some lenders have stricter requirements than this. It is important to keep in mind that there are situations when financial institutions are not allowed to provide loans to customers who have higher DTIs.

3. Capital

The amount of cash that a borrower contributes toward a possible venture is another factor that lenders consider. The borrower's likelihood of defaulting on the loan is reduced by the amount of contribution made by the borrower. Obtaining a mortgage, for instance, is normally much simpler for potential borrowers who can make a down payment on a property.

The amount of the borrower's down payment might also have an impact on the interest rates and conditions of the loan. In most cases, making a bigger initial payment will result in more favorable interest rates and other conditions. For example, in the case of mortgage loans, a borrower who makes a down payment of at least twenty percent of the loan's total value should be able to avoid purchasing extra private mortgage insurance (PMI).

4. Collateral

The use of collateral in the loan application process might be beneficial. It provides the lender with the peace that even if the borrower fails to repay the loan, the lender may still recoup part of their investment by taking back the collateral. The item purchased with the money is often used as the collateral for the loan. Mortgages and auto loans, for example, are secured by the vehicles being purchased with the money.

As a consequence, loans backed by collateral may also be referred to as secured loans or secured debt. It is widely accepted that they provide a lower level of risk for the lender to offer. As a consequence, loans secured by some collateral are often provided with lower interest rates and terms that are more favorable when compared to other forms of financing that are not secured.

5. Conditions

Lenders look at the borrower's income but also consider the general circumstances associated with the loan. This may include the applicant's length of service at their present position, the health of their industry, and the predictability of their future employment. The terms of the loan, including the interest rate and the size of the principle, have a role in determining whether or not the lender is willing to provide financing to the borrower.

Susan Kelly Oct 12, 2022

The Difference Between a 7(a) Loan And An SBA 504 Loan

Triston Martin Dec 05, 2022

Do Medicare Benefits Pay For Dental Implants

Susan Kelly Jan 05, 2023

Why Employer Student Loan Repayment Is Important

Susan Kelly Oct 23, 2023

Crossed Checks: Purpose and Process

Susan Kelly Sep 29, 2022

What Is The Best Time To Go Shopping?

Triston Martin Oct 15, 2022